Today’s Real Estate Market: The ‘Unicorns’ Have Galloped Off

foreclosure May 29, 2023

foreclosure May 29, 2023

September 26, 2023

Mortgage rates directly impact the monthly payment you’ll have on the home you purchase.

August 31, 2023

If you’ve been in your home for a while, you might have gained a considerable amount of equity, too.

August 30, 2023

Here’s a high-level overview of the connection between the inflation and housing market.

August 29, 2023

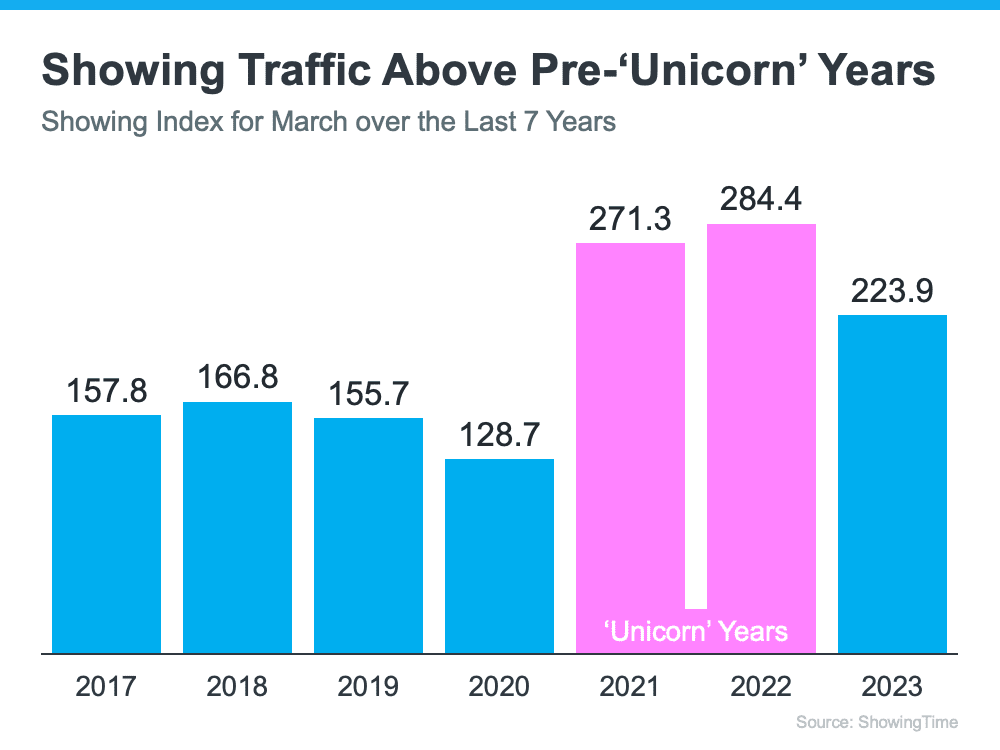

The latest data shows plenty of buyers are still out there, and they’re purchasing homes today.

August 28, 2023

Here’s some information you may find helpful on why and where your peers are buying.

August 23, 2023

If you’re thinking about selling your house, a strong job market, growing wages, and the resulting buyer demand is fantastic news.

August 17, 2023

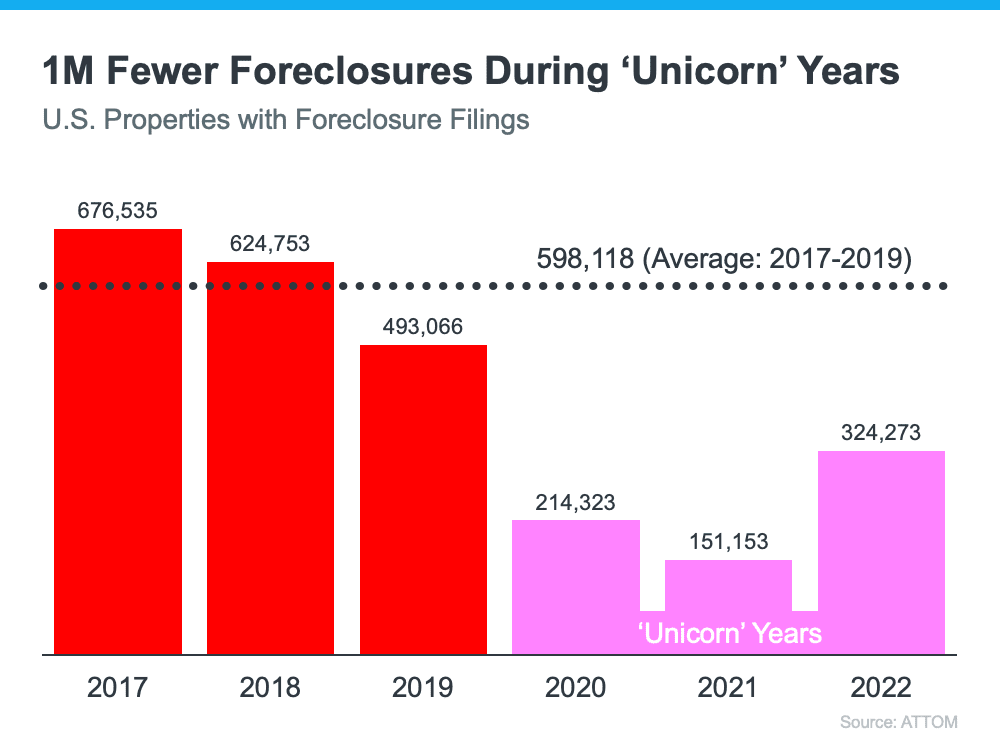

Since most are paying on time, a wave isn’t coming.

August 16, 2023

More people are buying less expensive newly built homes right now while affordability remains a challenge.

August 15, 2023

There aren’t many homeowners who are seriously behind on their mortgage payments.

We’re here to work alongside you to help you make informed decisions when buying or selling your home or investment. Contact us to get started today.